If you’re an aspiring financial professional, chances are you’ve come across two foundational courses: Bookkeeping and accounting. Both courses focus on driving accurate financial management and informed decision-making.

But which one is right for you? Start by understanding the basics of both and what differentiates them. Here’s everything you need to know about bookkeeping and accounting:

What is Bookkeeping?

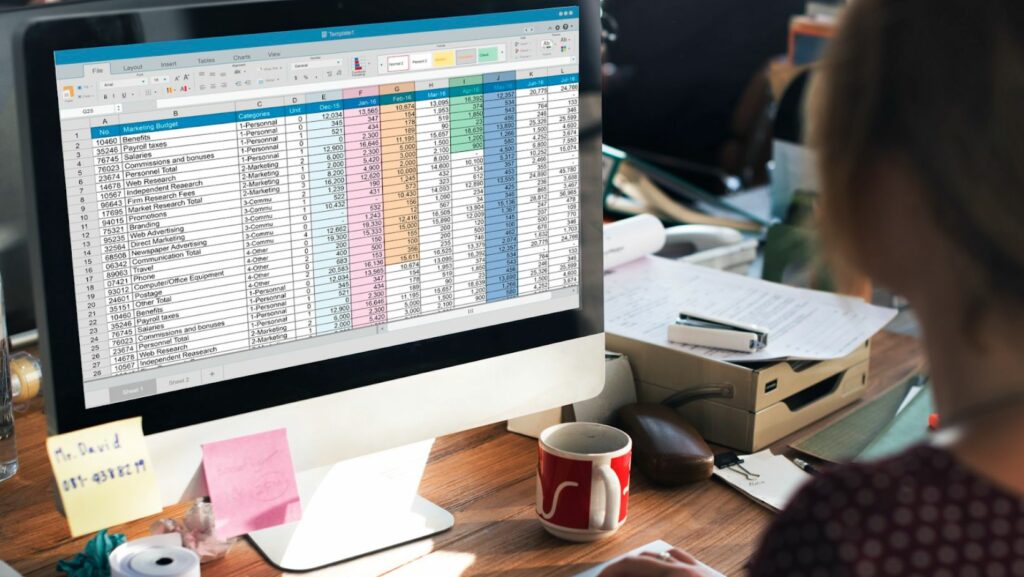

Bookkeeping forms the foundation of a business’s financial system. It is the systematic process of recording, organizing, and tracking a business’s financial transactions. A bookkeeper keeps track of payments, receipts, and purchases to ensure accurate records.

Here’s a detailed explanation of items bookkeepers track:

Assets – any business item that holds value is called an asset. Examples include cash, inventory, equipment, and property.

Liabilities – these are obligations that a business owes. Examples include loans, outstanding bills, wages, and taxes.

Revenue – this is the income generated by selling a product or offering a service.

Invoices – these include receipts of payments from vendors and contractors.

Expenses – this includes all the costs incurred to run a business. Examples include employee wages, supplies, rent, and utilities.

Payroll – this includes salaries, wages, and any benefits owed to the employees.

Bookkeeping helps maintain clear records of every deposit and withdrawal. Without it, a business can face reporting errors and even penalties.

To learn more, you can enroll in a bookkeeping course. You will learn how to track assets, manage accounting cycles, analyze financial statements, and more. Bookkeeping courses offered by Intuit Academy can help you build a sustainable career as a bookkeeper.

What is Accounting?

Accountants do more than just crunch numbers. They build upon the financial foundation set by bookkeepers and analyze financial records for strategic purposes.

For instance, an accountant will monitor a business’s financial performance and identify problem areas. They will analyze the bigger picture to plan for the future.

Here are three things that accountants do but bookkeepers don’t:

Sign off on year-end accounts. While a bookkeeper takes care of day-to-day expenses, an accountant makes sure the information is accurate and fits the larger financial goals.

They estimate tax returns. Accountants also identify potential deductions and credits to minimize a business’s tax burden.

They budget and forecast. Accountants use strategic tools to predict future revenues and cash flow.

Key Differences Between Bookkeeping and Accounting

Although bookkeeping and accounting seem to go hand-in-hand, they’re not as similar as some people think. Here are the key differences:

Scope and Objective

Bookkeeping focuses on the day-to-day financial activity of a business. Whereas an accountant helps make sure your financial records are compliant and accurate.

Skills and Qualifications

In the U.S., you generally don’t need formal education to become a bookkeeper. You can excel by taking a course. This isn’t the case with accounting. According to the U.S. Bureau of Labor Statistics, a bachelor’s degree in accounting or finance, along with relevant certifications, is typically required to work as an accountant.

Decision-making and Involvement

Bookkeepers generally don’t contribute to the financial future of a business. They organize data and keep track of all transactions. In comparison, accountants are directly involved in the decision-making process.